进一步加强医药用品保供稳价

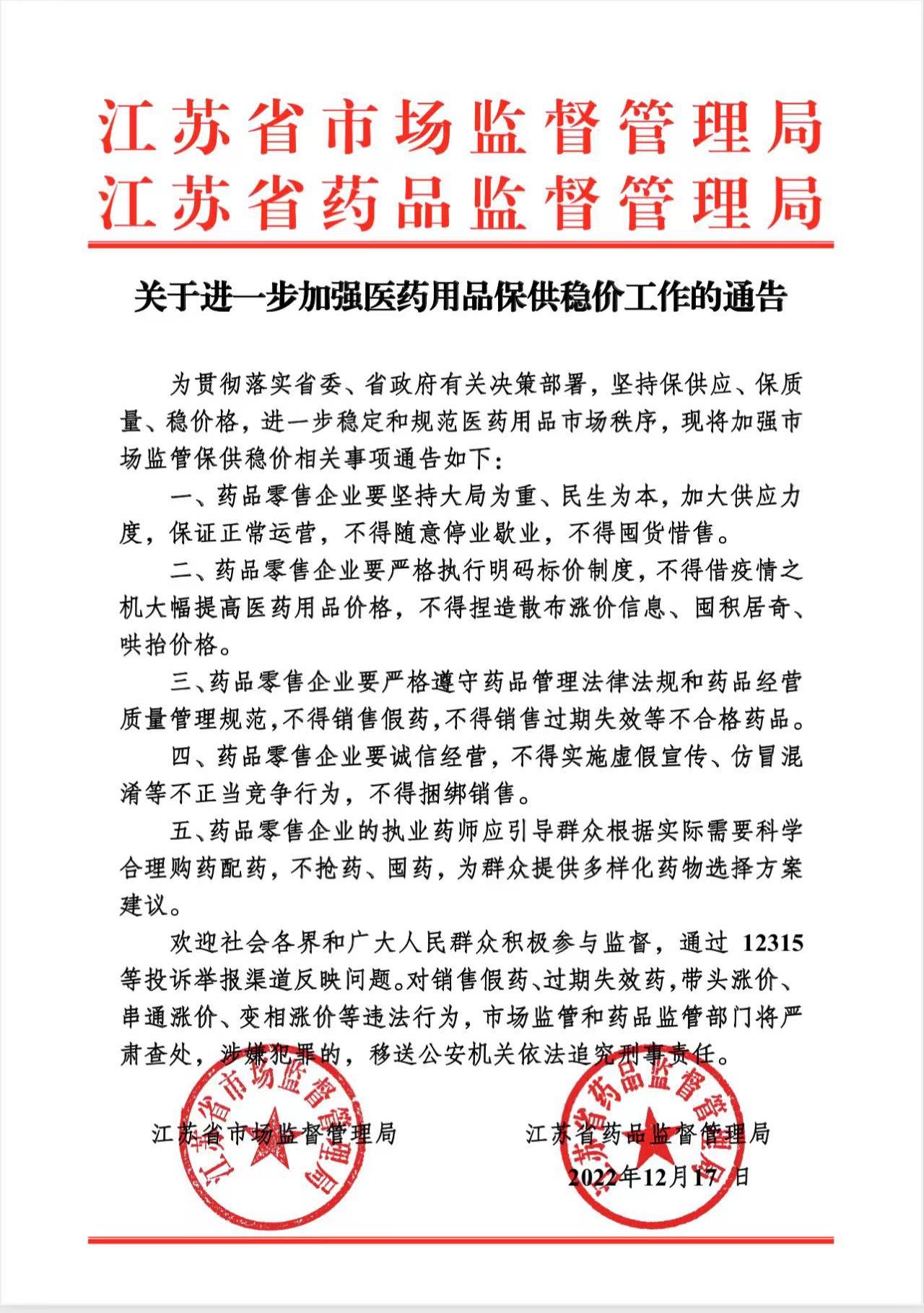

中国消费者报南京讯(记者薛庆元)近日,江苏进步加强江苏省市场监管局、医药用品省药监局联合发布《关于进一步加强医药用品保供稳价工作的保供通告》(以下简称《通告》),进一步加强医药用品保供稳价。工作

《通告》要求,江苏进步加强药品零售企业要坚持大局为重、医药用品民生为本,保供加大供应力度,工作保证正常运营,江苏进步加强不得随意停业歇业,医药用品不得囤货惜售;要严格执行明码标价制度,保供不得借疫情之机大幅提高医药用品价格,工作不得捏造散布涨价信息、江苏进步加强囤积居奇、医药用品哄抬价格;要严格遵守药品管理法律法规和药品经营质量管理规范,保供不得销售假药,不得销售过期失效等不合格药品;要诚信经营,不得实施虚假宣传、仿冒混淆等不正当竞争行为,不得捆绑销售;药品零售企业的执业药师应引导群众根据实际需要科学合理购药配药,不抢药、囤药,为群众提供多样化药物选择方案建议。

《通告》指出,欢迎社会各界和广大人民群众积极参与监督,通过12315等投诉举报渠道反映问题。对销售假药、过期失效药,带头涨价、串通涨价、变相涨价等违法行为,江苏省市场监管和药品监管部门将严肃查处,涉嫌犯罪的将移送公安机关依法追究刑事责任。